Irs Tax Updates For 2025. The irs is increasing the tax brackets by about 5.4% for both individual and married filers across the different income spectrums. The get ready page on irs.gov outlines steps taxpayers can take now to make filing easier in 2025.

Tax deductions, tax credit amounts, and some tax laws have changed since you filed your last federal income tax return. Irs will allow us taxpayers to file taxes digitally in the 2025 tax season.

Irs Refund Schedule 2025 Calendar Dates Sandy Valene, 29, 2025, as the official start date of the nation's 2025 tax season when the agency will begin.

2025 Tax Return Tonye Vernice, Effective jan 1 2025, irs has updated the federal tax brackets.

Spring 2025 Transcripts carlyn madeleine, 29, 2025, as the official start date of the nation's 2025 tax season when the agency will begin.

Federal Tax Brackets 2025 Calculator Vonni Johannah, Ready or not, the 2025 tax filing season is here.

IRS Tax Bracket 2025 Update These Americans Will Be Paying More, The rates remain at 0%, 10%, 12%, 22%, 24%, 32%, 35%, or 37% but the ranges have been adjusted for.

IRS Tax Credit Schedule Payment Dates and Amount Updates for August, As of january 29, the irs is accepting and processing tax returns for 2025.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, The irs is introducing new income limits for its seven tax brackets, adjusting the thresholds to account for the impact of inflation.

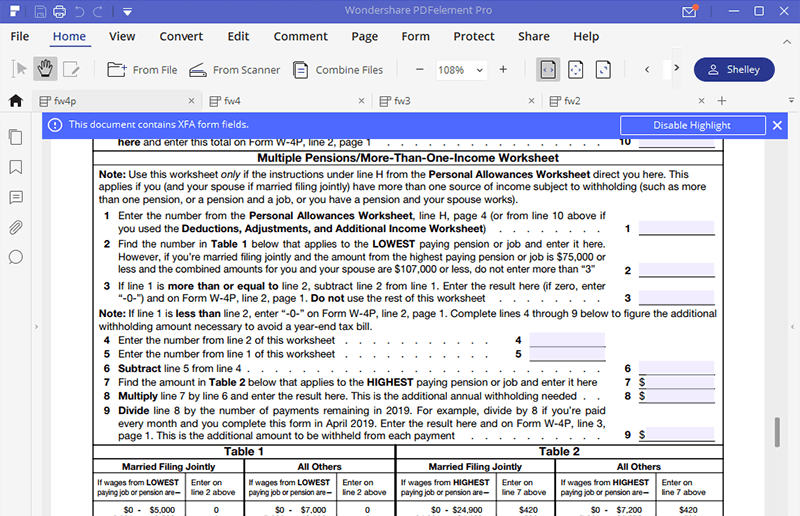

Irs W4p 2025 Cecil Adelaide, Learn about online account enhancements, refund timings, document preparations, and new tax credit opportunities.

Irs 2025 W4p Tax Form Greta Nadean, The rates remain at 0%, 10%, 12%, 22%, 24%, 32%, 35%, or 37% but the ranges have been adjusted for.

Irs Tax Calculator 2025 Estimator Bekki Carolin, The get ready page on irs.gov outlines steps taxpayers can take now to make filing easier in 2025.